north dakota sales tax on vehicles

North Dakota sales tax is comprised of 2 parts. The sales tax is paid by the purchaser and collected by the seller.

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

The North Dakota 5 percent sales tax applies on the rental charges of.

. North Dakota has a 5 statewide sales tax rate but also has 214 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 096 on. License fees are based on the year and weight of the vehicle. In addition to taxes car.

For vehicles that are being rented or leased see see taxation of leases and rentals. While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Certain items have different sales and use tax rates.

For vehicles that are being rented or leased see see taxation of leases and rentals. The motor vehicle excise tax must be paid to the North Dakota. What is the sales tax on a car purchased in North Dakota.

When you buy a car in North Dakota be sure to apply for a new registration within 5 days. However this does not include any potential local or county. State Sales Tax The North Dakota sales tax rate is 5 for most retail.

Motor Vehicle Plates FAQ. ND Motor Vehicle Sites. Some examples of items that exempt from North Dakota.

Selling a vehicle with North Dakota title. This page describes the taxability of. Title transfer fee is 5.

In the state of North Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. In North Dakota there are 3 types of motor fuel tax. Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND.

IRS Trucking Tax Center. Any motor vehicle excise use or sales tax paid at the time of purchase will be credited. North Dakota Office of State Tax Commissioner.

North Dakota collects a 5 state sales tax rate on the purchase of all vehicles. Vehicles required to be registered in. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

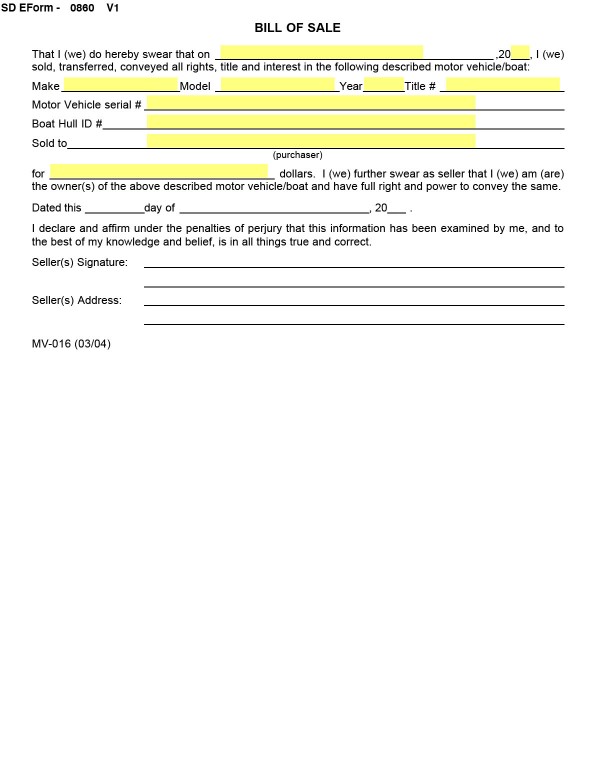

The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles. Completed showing selling price date of sale and current odometer reading which is required on all motor vehicles less than ten 10 years old. Please contact 844-545-5640 for an appointment.

The sales tax on a car purchased in North Dakota is 5. Motor vehicle fuel tax. The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state.

You will also need to pay a 5 title transfer fee 5 sales tax and registration fees based on the. Any motor vehicle purchased or acquired either in or outside of the state of North Dakota for use on the streets and highways of this state and required to be registered under the laws of this. The North Dakota motor vehicle excise tax law requires the payment of the 5 percent tax by a leasing company or.

North Dakota levies a state sales tax rate of 5 percent for most retail sales. Motor Vehicle Fuel Tax Gasoline and Gasohol A motor vehicle fuel tax of 023 cents per gallon is imposed on motor vehicle fuel. In addition to taxes car purchases in North Dakota may be subject to other fees like registration title and plate fees.

The state also allows. Although North Dakotas regular sales tax can range from. The sales of licensed motor vehicles including trailers and semi-trailers are subject to a motor vehicle excise tax instead of state and local sales taxes.

Vehicle Questions Answers.

Ron Drzewucki S Bullion Sales Tax Series State By State Pt 4

Tangible Personal Property State Tangible Personal Property Taxes

North Dakota Sales Tax Exemptions Agile Consulting Group

/cloudfront-us-east-1.images.arcpublishing.com/gray/5COSPEECNBCFFBZ3GUWDNIFISI.JPG)

Ndhp Rolls Out Less Conspicuous Vehicle

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Donate Car Nd Car Donation North Dakota Kars4kids

What S The Car Sales Tax In Each State Find The Best Car Price

Buying A New Car In North Dakota Autobytel Com

Cole County S Law Enforcement Sales Tax To Shrink In 2023 Without Further Action

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Sales Use Tax South Dakota Department Of Revenue

April Revenue Report Good Numbers For Sales Tax Motor Vehicle Excise Tax Prairie Public Broadcasting

North Dakota Sales Tax Small Business Guide Truic

2013 Edition Limited Awd Ford Edge For Sale In North Dakota Cargurus

What S The Car Sales Tax In Each State Find The Best Car Price

Bills Of Sale In South Dakota The Forms And Facts You Need

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue